Market Melt-Up Risk Grows

Published Wednesday, December 15, 2021 at: 5:43 PM EST

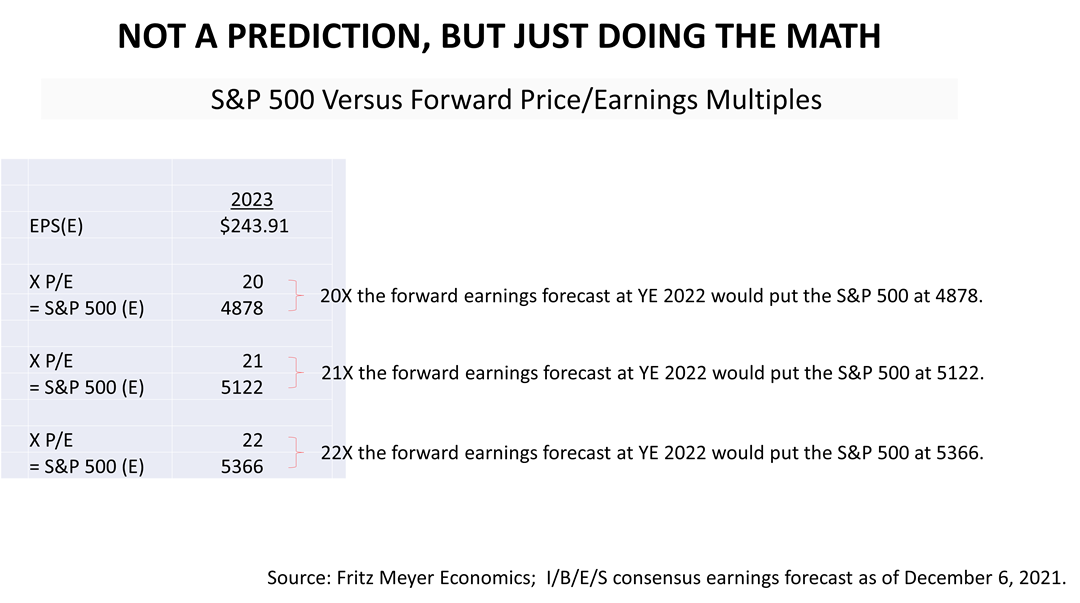

This is not a prediction but, if you do the math, earnings could drive the stock market higher in the months ahead. Predicting the market is risky business but professional prudence requires a realistic set of expectations about the future supported by math. Professional prudence requires realistic expectations supported by math. The current math indicates the market is at risk of melting up.

To be clear, a lot of people think the stock market is not connected to any reality, irrational, whimsical, or like going to a casino. But that’s not how financial economics works. While earnestly attempting to avoid hyperbole or sensationalism, here’s the math explaining why the stock market could rise sharply in 2022, why a virtuous cycle is being triggered in which economic growth causes earnings growth at America’s largest public companies, driving stock prices higher.

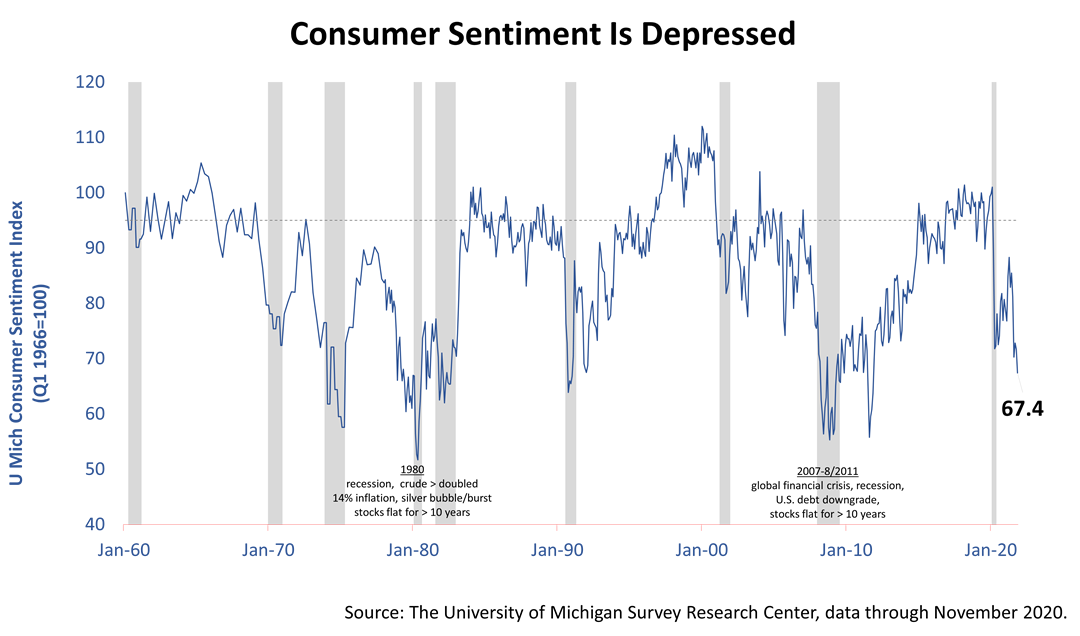

Although markets may form bubbles, bubble barometers are currently nowhere near the red zones reached during the last stock market bubble, which ended with the tech stock bust of 2000. For instance, the consumer sentiment indicator, which grew irrationally exuberant in the last bubble in stocks in the late 1990s, is currently depressed compared to its long-term trend in the gray line.

Meanwhile, household net worth, a quarterly figure from the Federal Reserve, released December 9, for the period through September 2021, has surged during the pandemic on stock market and real estate gains. The “wealth effect” historically kicks in and ebullient investors reinvest their gains, and it creates a circular dynamic. When household net worth goes higher, it stimulates spending, which stimulates higher stock prices. And you can have a virtuous circle. So, household net worth can be a significant measure, and the wealth effect is something real, and it is doing something that hasn’t happened since the last bubbles in both the stock market and real estate.

Ultimately, however, earnings drive stock prices and doing the math indicates a surge in stock prices could occur. Fritz Meyer, an independent economist, says the S&P 500 stock index is currently trading at a multiple of 21 times their expected earnings for the 12 months through the end of 2022. If you apply that same forward earnings multiple of 21 to the earnings expected in 2023, where would that put the Standard & Poor’s 500 stock index at the end of 2022? The answer: the S&P 500 would be priced at 5122 versus its closing value midday price of 4626. That would be about a 10% gain, and it would follow on a gain, so far in 2021, with only two weeks let in the year, of 25%.

Let's just do the arithmetic. Twenty times forward earnings at the end of 2022 would put the market at 4878, and today we're at 4625 today. If you apply a forward earnings multiple of 21 times that 2023 estimate, we would be at 5100 at the end of next year. And if 22 times, we'd be at 5300. Simply doing the arithmetic, applying a forward P/E multiple to earnings estimates a year from now, trying to figure out where we could possibly be on the S&P 500 a year from now.

In the stock market bubble of 2000, the S&P 500 traded at more than 24 times expected 12-month earnings throughout 1999 and into early 2000, according to data from Yardeni Research. A 24 multiple would take stock prices higher by about 20%. Heightening the risk of a melt-up in stock prices, yields on bonds have never been as low in U.S. history. With bonds so low, stock valuations could head higher because bonds – the usual alternative to stocks -- are less attractive relative to stocks.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

©2021 Advisor Products Inc. All Rights Reserved.