Retirement Planning Alert For Current Financial Economic Circumstances

Published Wednesday, August 18, 2021 at: 9:52 AM EDT

Here’s a retirement planning alert built for current financial economic circumstances—an explanation of the current situation followed by a timely and high-value retirement investing tip.

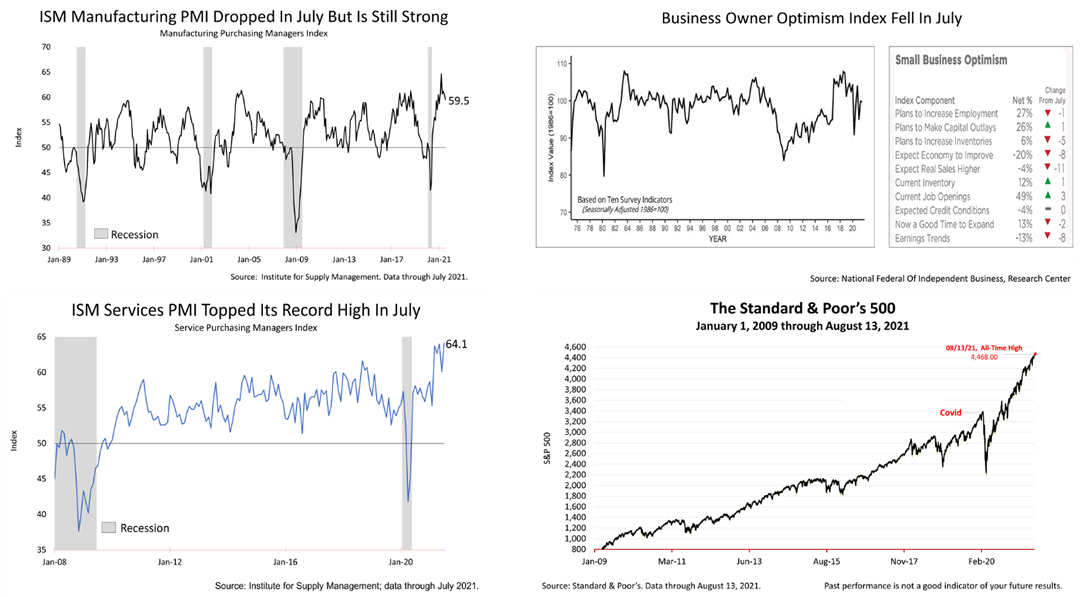

The manufacturing purchasing managers index ticked lower in July but it’s not too far off from its all-time record-high, while the service sector purchasing manager index shot higher, breaking a new record high. The service sector accounts for 89% of U.S. economic growth.

Meanwhile, business owner optimism ticked lower in July and the S&P 500 hit a new record high for the 48th time in 2021.

The Optimism Index, a monthly survey of business owners, decreased by 2.8 points in July to 99.7, reversing nearly the entire 2.9-point gain in June’s report. Notably, 49% of business owners reported job openings that could not be filled, an increase of 3 points from June and a 48-year record high.

Since the March 23rd, 2020, Covid bear market low, the Standard & Poor’s 500 stock index is up more than 60%! Inflation uncertainty and the Covid variant could cause a sharp drop in stock prices anytime, but a recession is not threatening and the economy is growing fast.

Financial conditions, as they are currently, make it wise to consider whether the next sharp drop in stock prices would present a strategic tax opportunity to convert traditional IRA or 401(k) assets invested in stocks into tax-free Roth IRAs.

With tax rates expected to be going up, and the stock market breaking records for 11 months, retirement savers should proactively investigate converting to a Roth IRA in 2021.

A Roth IRA conversion gives you a tax-free income stream for life and, when you die, your spouse gets tax free income for life, too. Your children or other non-spouse beneficiaries get tax free income for 10 years and then a tax-free lump sum inheritance after 10 years.

This is an important tip that we cannot emphasize enough but it requires action by the end of 2021.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

©2021 Advisor Products Inc. All Rights Reserved.