Poor Bond Outlook May Herald A New Stock Valuation Regime

Published Wednesday, Sept. 9, 2020; 3:30 PM EST

(Wednesday, Sept. 9, 2020; 3:30 PM EST) With a 10-Year Treasury bond currently yielding a paltry 0.6%, and Federal Reserve chief Jerome Powell saying the central bank is "not even thinking about thinking about raising rates," investors could be at the dawn of a new era of expanded stock multiples.

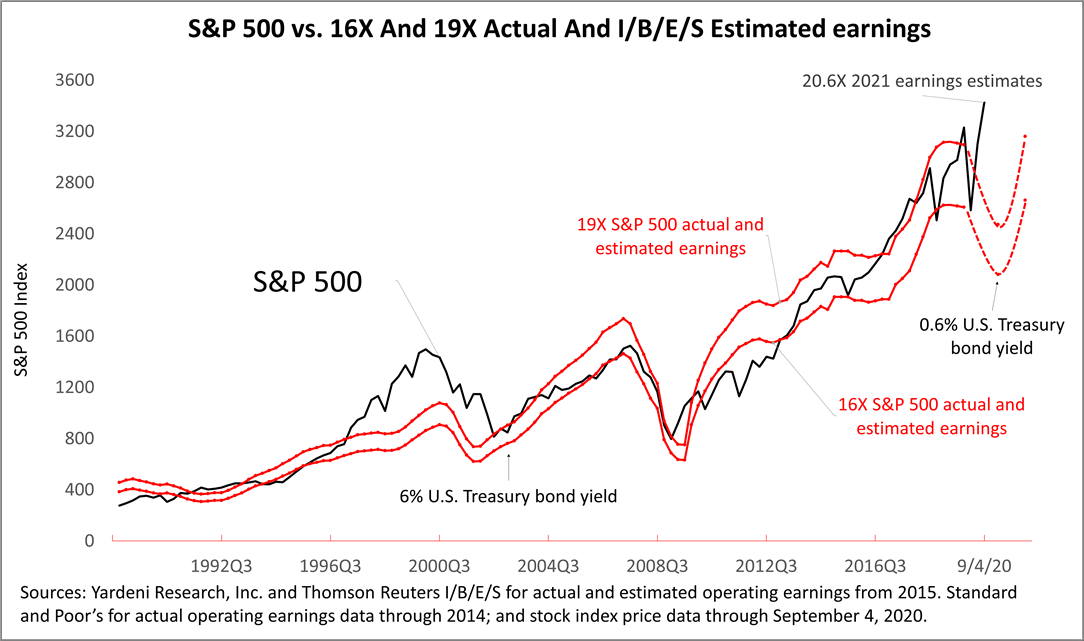

The solid red lines in the accompanying chart illustrate the historical p-e ratio of 16 and 19 and the black line shows the actual S&P 500 index. The dotted red lines on the right side of the chart illustrate the valuation band through the end of 2021, based on projections from Wall Street analysts and collected by Institutional Brokers' Estimate System (IBES), a Thomson Reuters company. With the S&P 500 current p-e multiple at 20.6, the price of the S&P 500 in the black line is way above the upper end of the valuation band of 19. This indicates a new era of higher valuations on stocks be dawning. The sources of the data are Yardeni Research, Inc. and Thomson Reuters I/B/E/S for actual and estimated operating earnings from 2015; Standard and Poor's Corp. for actual operating earnings data through 2014 and stock index price data through September 4, 2020. The actual earnings in 2019 were $162.97. Estimated earnings for 2020 are $130.13 and $166.43 in 2021.

This is not a stock market prediction; it's just the facts about fundamentals that support a case for a new paradigm of higher valuations on stocks.

For decades, the average share price of a company in the Standard & Poor's 500 has traded at a multiple of between $16 and $19 for every $1 of profits expected in the next 12 months. However, with bonds yielding less than 1%, stocks are more attractive. Applying the historical p-e valuation band of 16 to 19 would be investing solely based on what's happened in the past, like driving a car based on what you see in your rear-view mirror. But is your portfolio positioned for what's ahead?

According to the Fed's recent public statements, current financial economic conditions, which are characterized by 10-year U.S. T-bond yields of less than 1% and 1.5% annual inflation rate for a decade, are unlikely to change anytime soon. The decline in the relative value of bonds makes stocks a more attractive investment. So, it's reasonable to expect money to be driven into stocks and raise share prices. To be clear, this could be the dawn of a new era of justifiably higher price-to-earnings (p/e) ratios.

Since bond yields have never been this low before, no one knows how much more stocks may be worth relative to bonds and precisely what the p-e ratio should be. This uncertainty may contribute to big swings in stock prices, like the one that's unfolded over the past few days.

Long-term investors may want to consider how an expansion of the market's valuation multiple might affect their personal portfolio.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

©2020 Advisor Products Inc. All Rights Reserved.