Growth Of The Consumer Class And The Investment Outlook

Published Thursday, February 6, 2020 at: 7:00 AM EST

Friday, February 14, 2020 - Whatever your views on income inequality, the trend toward a larger and wealthier middle-class is good for consumer spending, which drives 70% of the economy. For investors, that's positively fundamental.

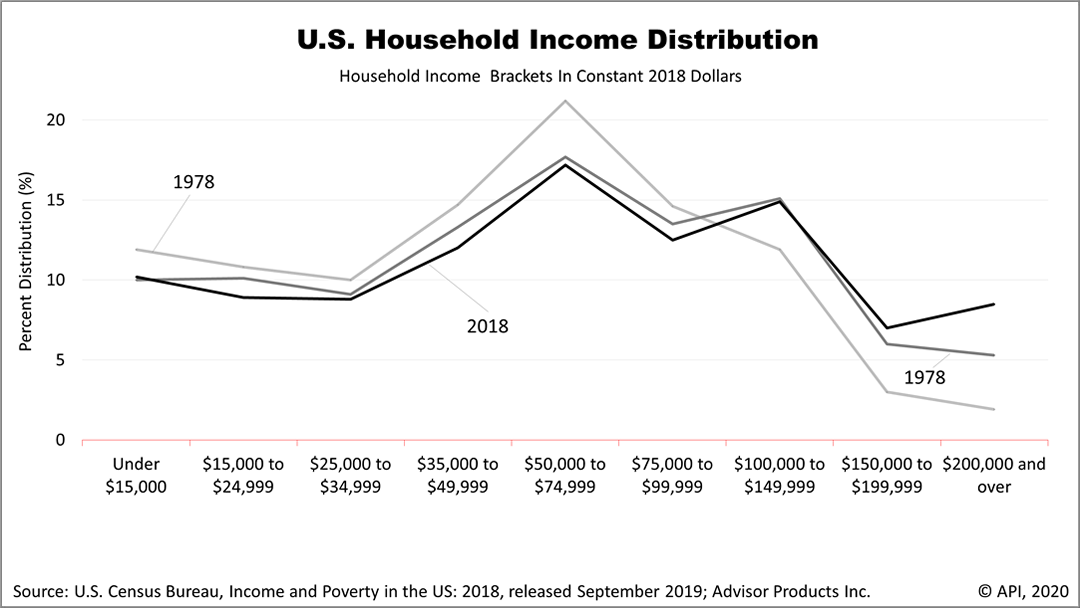

Income distribution data in this chart won't answer all the complex questions surrounding income inequality but are useful in understanding this key fundamental economic trend, which drives the investment outlook.

The three lines show the distribution of household income at 20-year intervals: 1978, 1998, and 2018. The black line is evidence that growth in the number of households with $100,000 to $149,999 in income accelerated over the last 20 years, and sharply from 1978.

The proportion of U.S. households with between $50,000 and $74,999 in income dropped because there are many more households making $100,000 to $149,999 and up, changing the character of the middle class. The U.S. had fewer middle-income households in 2018 because we had more higher-income households. In addition, a percentage of the total number of U.S. households in the lowest income brackets declined.

(U.S. Census Bureau income estimates are based solely on income before taxes and do not include non-cash benefits such as food stamps, Medicare, Medicaid, public housing, and employer-provided fringe benefits.)

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal. Past performance is no guarantee of future results.?? Return and principal value of an investment will fluctuate, and when redeemed, may be worth more or less than their original cost. Performance statistics quoted here may be lower or higher now.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind., and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not ??a guarantee of future results.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.