The Truth About U.S. GDP Growth

Published Tuesday, September 18, 2018 at: 7:00 AM EDT

Second-quarter economic growth surged 4.1%, the best it's been since the third quarter of 2014.

Almost immediately, the strong GDP report sparked debate as to whether it was a one-time shot.

Here are the facts.

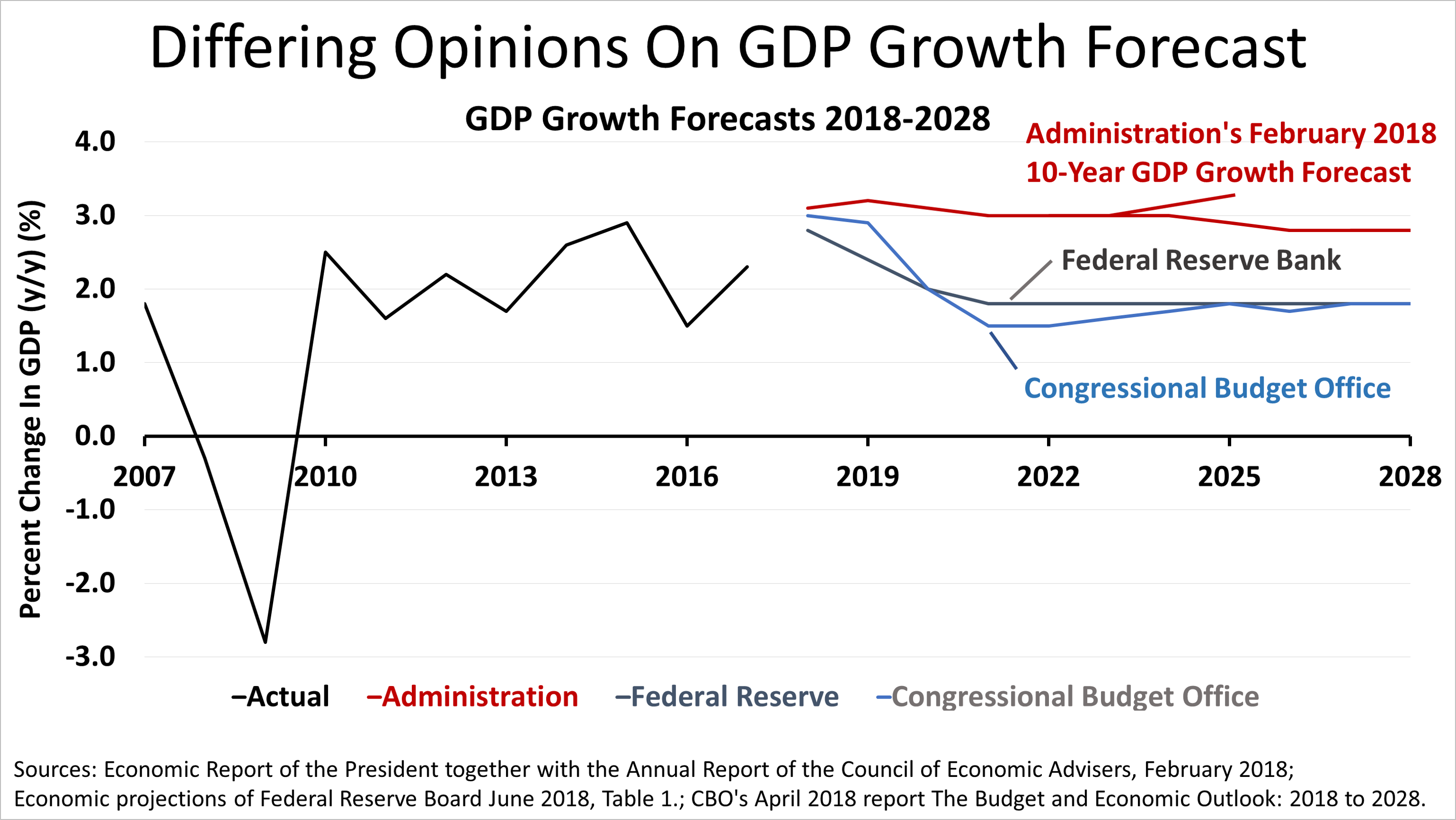

This chart shows the Trump administration's forecast for GDP growth versus forecasts from the non-partisan Congressional Budget Office and the U.S. Federal Reserve.

The difference between the Trump administration's growth forecast and those of the CBO, Fed, and private economists surveyed in The Wall Street Journal is explained by differing opinions about supply-side economics.

Most economists remain skeptical of the economic benefits that will result from the recent cut in federal taxes.

That's the facts.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.