10 Years After The Great Recession

Published Wednesday, May 2, 2018 at: 7:00 AM EDT

Ten years ago, the economy was bleak. The U.S. was in a recession. The subprime mortgage crisis was undermining Bear Stearns, Lehman Brothers, Countrywide Financial, AIG, and other major financial institutions; General Motors looked like it might go out of business. Then, in a story for the ages, the nation bounced back and led the world out from The Great Recession.

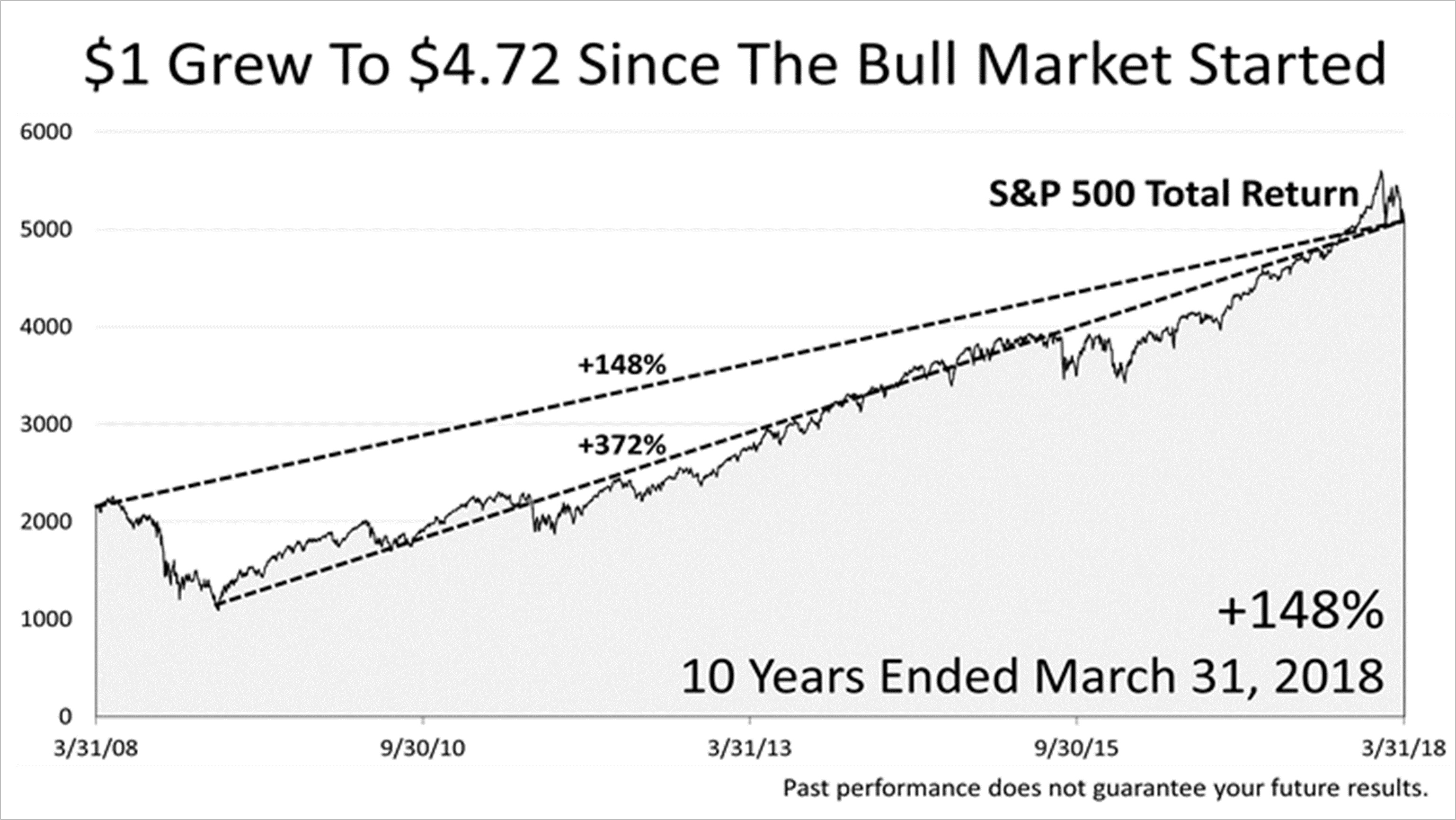

Over the last 10 years, a dollar in America's 500 largest public companies grew to $2.48. From the stock market's low point on March 9, 2009, a dollar appreciated in value 4.75 times, to $4.72 - a 372% return!

For the past decade, what makes America exceptional was in plain sight but difficult to see in the moment. It's never easy to see why U.S. stocks would gain in value. The current period is no different.

Share prices plunged 10.2% in early February, on inflation jitters, and again in March, on fears of a trade war. In April, The Wall Street Journal warned of a long period of weakness and cracks in global growth. Things looked bleak.

We're here to remind you that U.S. leading economic indicators released in April continued a long surge far beyond the highest point of the last expansion. This key forward-looking composite of 10 indicators points to solid growth for the rest of 2018. Despite the headlines, increased market volatility, and a weak first quarter return on stocks, very strong economic fundamentals remain in place. We're here to help you manage your portfolio for the long run.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.