Can You Avoid Estate And Gift Tax?

Published Tuesday, January 13, 2015 at: 7:00 AM EST

Are you hoping to pass investment assets to your heirs without any tax damage? Under the current rules, you have plenty of leeway to avoid estate and gift taxes on the federal level, although state taxes may be another story. However, keep in mind that your investment returns may outpace the inflation adjustments to the personal gift and estate tax exemption - and this could mean that your wealth will grow enough to be subject to taxes when you die.

There are two main estate and gift tax breaks: the annual gift tax exclusion and the unified estate and gift tax credit.

1. Annual gift tax exclusion. You can give each recipient, such as a younger family member, assets valued up to $14,000 a year without paying any gift tax (or even having to file a gift tax return). The exclusion is doubled to $28,000 for joint gifts made by a married couple. So, if you and your spouse each give the maximum $14,000 to five other family members, you can reduce your taxable estate by $140,000. And you can do this year after year.

The annual gift tax exclusion is indexed for inflation but rises only when the cost of living increases enough to result in a $1,000 bump to the exempt amount. With inflation very low in recent years, increases have slowed to a crawl. The last adjustment was made in 2013, from $13,000 to the current $14,000.

2. Unified estate and gift tax credit. This generous credit can wipe out either estate taxes, gift taxes, or a combination of the two.

After a decade of gradual increases, Congress permanently locked in the exemption amount at an inflation-adjusted $5 million. For 2017, the exemption is $5.49 million. That means a couple easily can shelter more than $10 million in assets from estate tax, although any lifetime gifts exceeding the annual gift tax exclusion will reduce the amount available to help an estate avoid estate taxes.

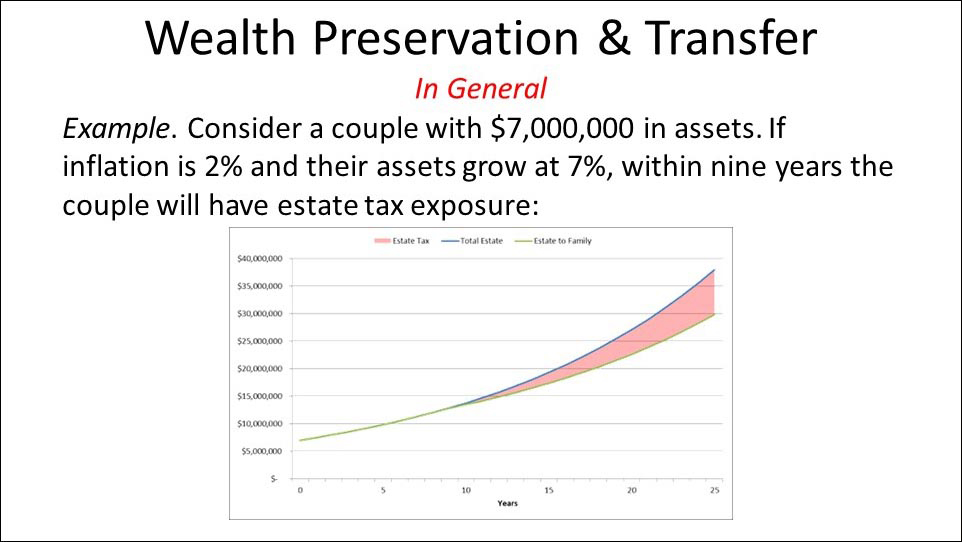

But you can't simply take this tax shelter for granted. Remember that your assets may appreciate in value at a rate greater than the annual inflation adjustments for the estate tax exemption. (Of course, assets also might decline in value.) This is especially true if the recent trend in low inflation persists. For example, suppose a couple has $7 million in assets and earns an annual average return of 7%. If the inflation rate remains at 2%, it will only take nine years for the couple to face federal estate tax exposure.

For those in the danger zone, tax-sheltered trusts and other techniques could help safeguard assets from estate tax. In addition, making annual tax-exempt gifts for several years can help reduce the eventual size of the estate.This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.