Should You Care About Wall Street Stock Market Predictions?

Published Friday, January 14, 2022 at: 7:25 PM EST

Wall Street’s forecast for 2022 is for a 4% gain in the Standard & Poor’s 500 stock index. But what does that really mean? Should you care? The answer is “not so much.” Wealth management is not predicated on predicting the stock market’s performance over the next year.

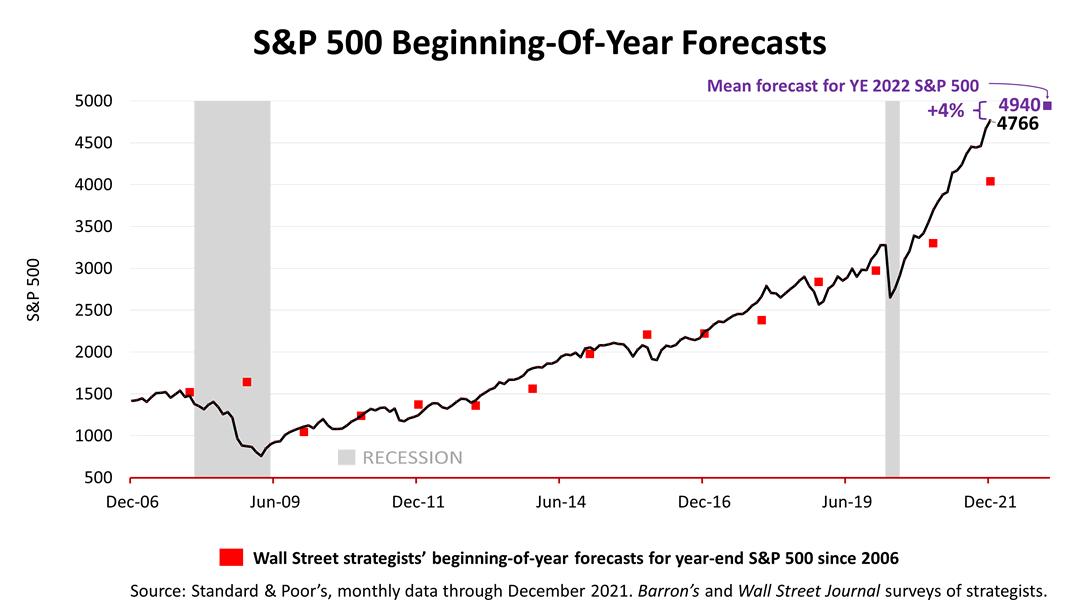

No one can reliably predict stock prices year after year and Wall Street’s no exception, according to this chart by independent economist Fritz Meyer. If the consensus forecasts by top strategists on Wall Street had been accurate since 2006, the red dots would all fall on the black line representing the S&P 500.

Illustrating how wildly wrong Wall Street’s best experts can be, in December 2020, the consensus forecast of the 10 strategists was for the S&P 500 to close 2021 at 4040. However, the S&P 500 closed 2021 at 4766, exceeding Wall Steet’s consensus forecast by more than 20 percentage points! The actual gain was three times Wall Street’s expectations!

We don’t wish to perpetuate the myth that investing successfully is predicated on predicting the stock market’s one-year performance. Building wealth involves tax management of your investments, adhering to a discipline, and a plan optimized for the rest of your life, that takes care of your family.

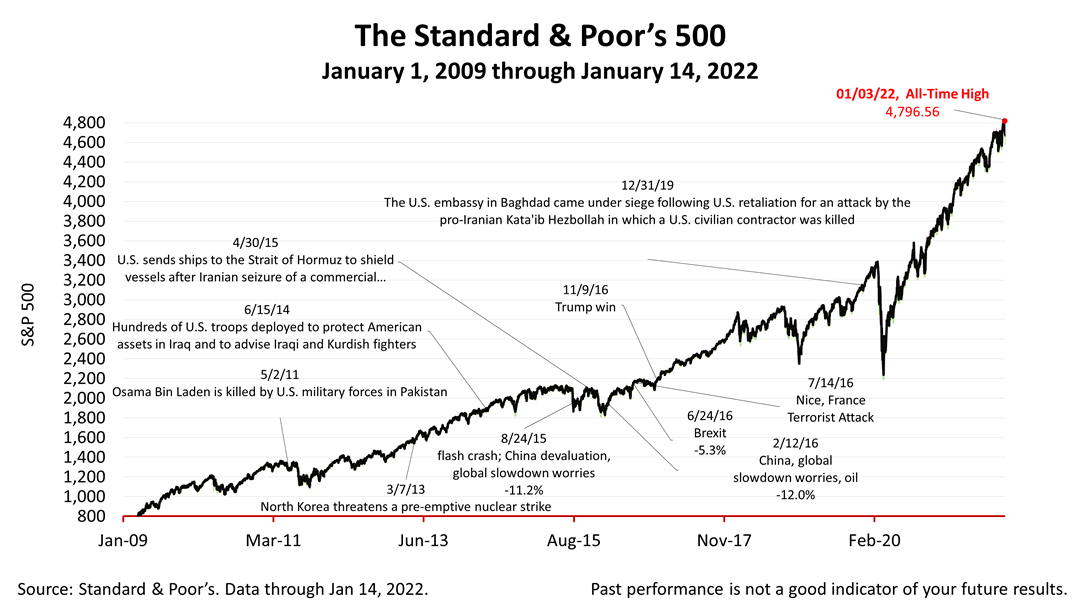

The S&P 500 stock index closed Friday at 4,662.85, about 3% lower than its January 3 record-high. A key measure of the confidence in the future of the United States, the S&P 500 price was essentially flat for the day. Gaining a scant +0.08% from Thursday, the index lost three-tenths of 1% from a week earlier. Since the March 23, 2020, pandemic bear market low, the S&P 500 is up +70.3%.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

©2022 Advisor Products Inc. All Rights Reserved.