This Week’s Economic And Investment News

Published Friday, July 30, 2021 at: 9:52 PM EDT

Here’s what happened in the economy this past week affecting investors:

- The Federal Reserve said the recovery was making progress and is holding its course .

- The economy grew at a 6.5% annual rate for the quarter ended June 30th.

- Inflation persisted at the highest level in years .

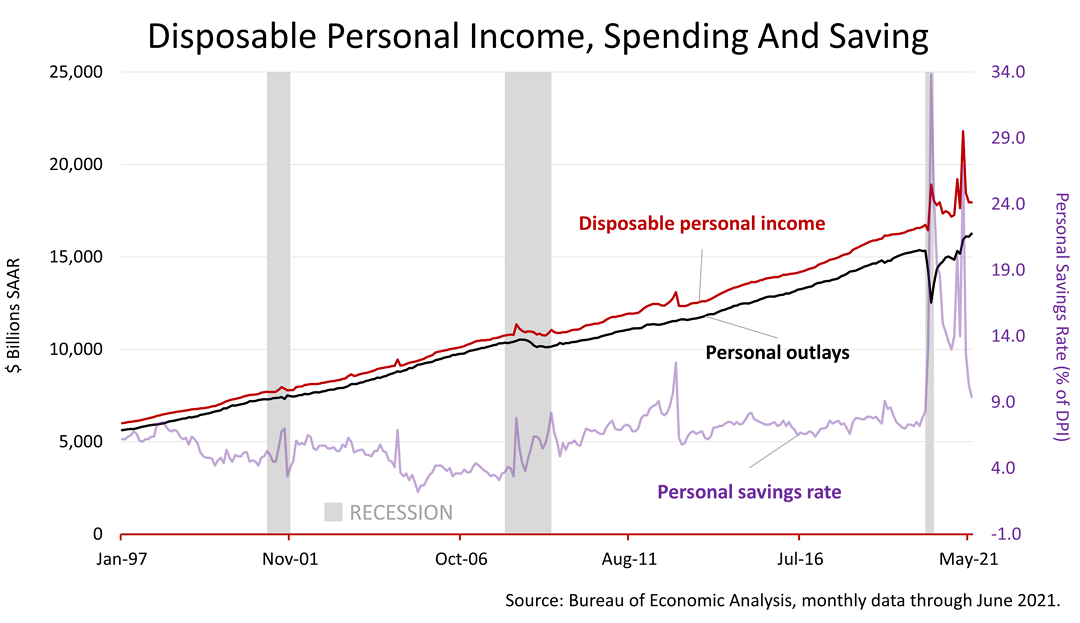

- Disposable income, personal savings and consumer spending. reverted closer to their historical levels but remained extremely strong

After the meeting by the Federal Reserve Board’s top policymaking committee on July 27 and July 28, the Fed issued a press release and used the same language as it has in the past regarding inflation. However, the language used in the Fed release about its policy of quantitative easing -- where it purchases long-term Treasury bonds and mortgage-backed bonds to add liquidity to the economy -- changed slightly. While the Fed had previously said it would continue the asset purchases until substantial progress had been made toward its goal of full employment and stable prices, the Fed statement now added that “the economy has made progress toward these.” This signals that the Fed might begin to taper back on QE purchases starting as early as September or October.

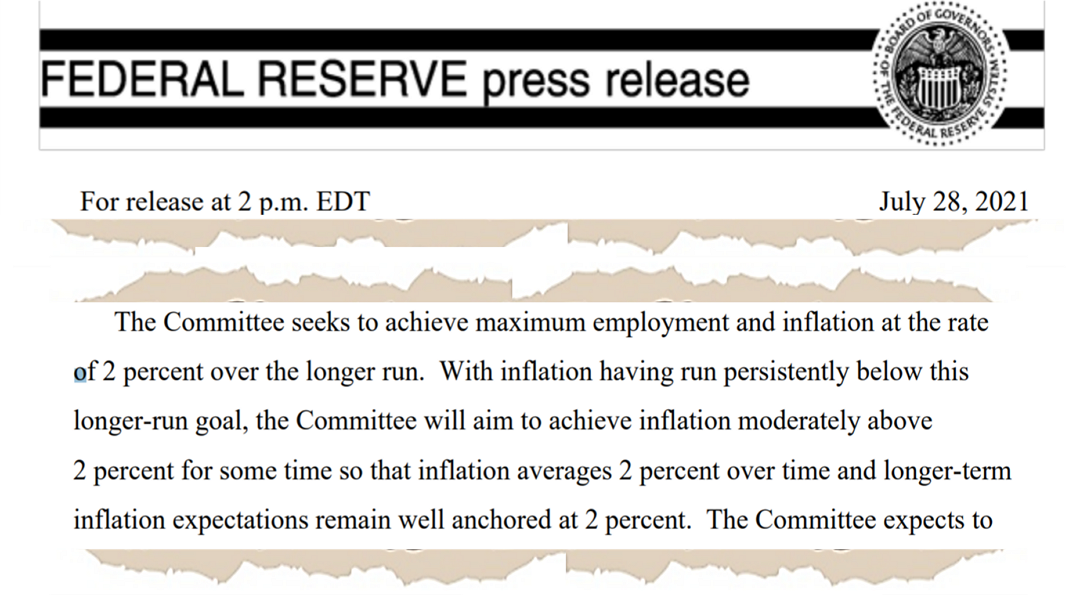

The economy grew at a 6.5% annual rate for the quarter ended June 30, according to the Bureau of Economic Analysis release yesterday. It was slightly lower than expected but much stronger than the quarterly rate before the Covid pandemic.

Meanwhile, the latest survey of 60 economists surveyed in early July shows the consensus forecast for the five quarters ahead (in red) shows that the experts expect above-normal growth to continue for the next two or three quarters.

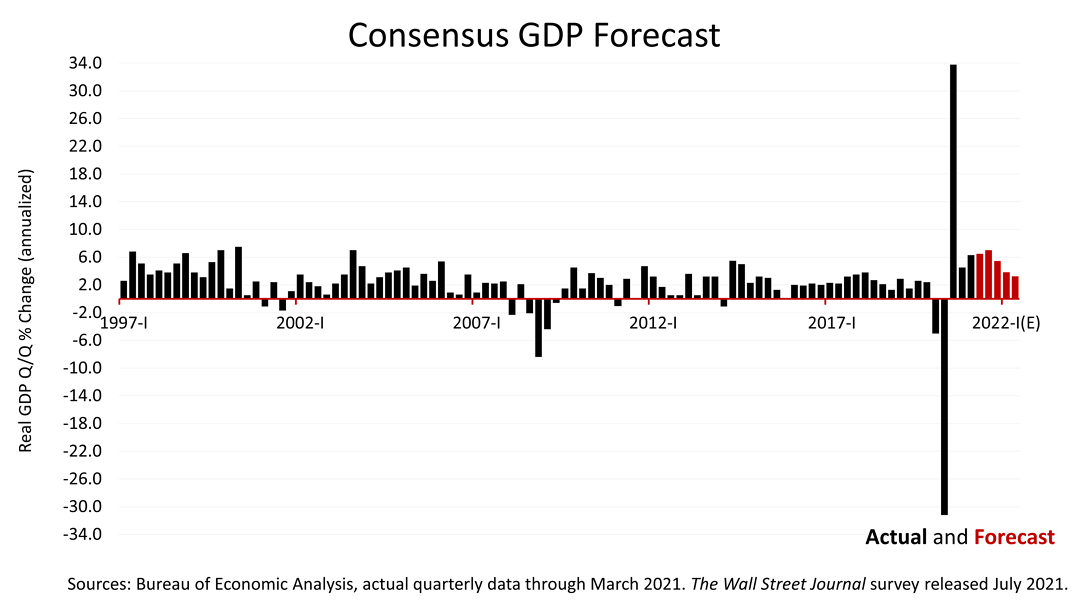

The inflation metric used by the Fed to set interest rates, the Personal Consumption Expenditure Deflator, was released today and it offered no big surprises. Yet it remains the biggest known risk to the financial economy.

The dotted lines on the right show the Fed is forecasting that inflation will plunge in January 2022, with the PCED landing between 1.9% and 2.3%, versus the current 4% rate. That is a drastic drop in inflation that the Fed expects to occur just six months from now. Whether the Fed is right will remain unknown until February 2022.

This morning’s data from the Bureau of Economic Analysis showed that the savings rate continued falling but remains elevated and is still strong relative to its historical norm. The savings rate spikes (in the purple line) occurred after a government stimulus of $5.3 trillion was enacted in response to the Covid pandemic.

Disposable personal income (DPI) remains elevated. DPI is about as high as it would have been if the pandemic never happened. Meanwhile, personal outlays ticked up last month, as consumers continued their spending spree. The unprecedented government payments have kept the American economy running like the pandemic never happened and the expansion that began in March 2009 and ended February 2020, never ended. Again, this is due to the unprecedented government reaction.

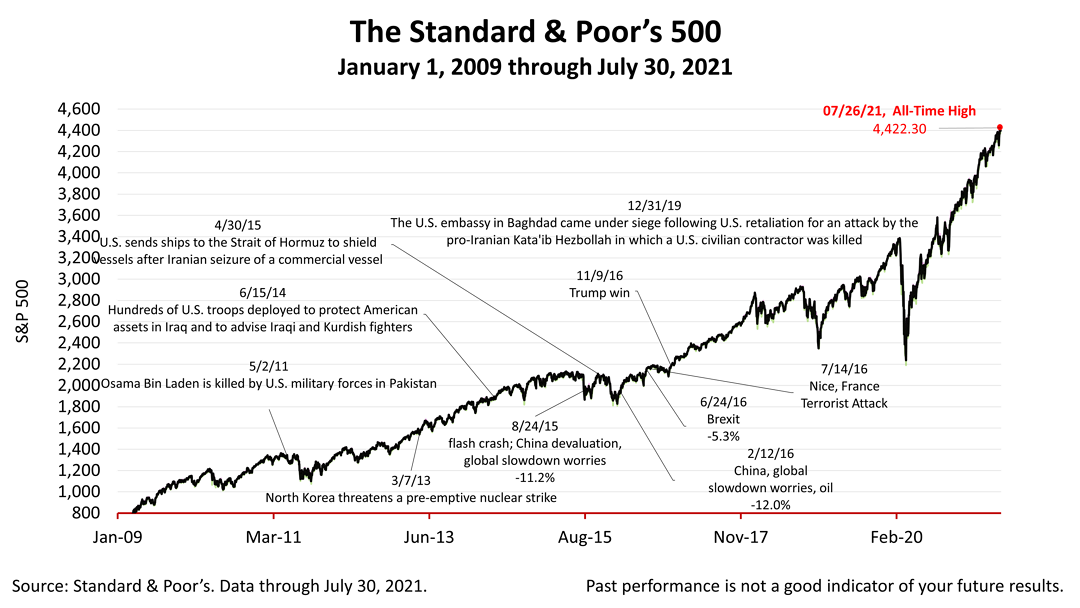

The Standard & Poor’s 500 stock index closed this Friday at 4,395.26. The index lost -0.5% from Thursday and closed -0.6% lower than Monday’s all-time high. Since falling -33.9% from early February to March 23, 2020, the S&P 500 is up +65.06% from the March 23, 2020, bear market low.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial situation, or particular needs. Product suitability must be independently determined for each individual investor. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

©2021 Advisor Products Inc. All Rights Reserved.