Why Stocks Shrugged Off Iran Escalation

Published Friday, January 3, 2020 at: 7:00 AM EST

As the U.S. Government was reportedly sending additional troops to the Mideast, after killing a top Iranian leader, fear of Iran's asymmetric warfare tactics spread. The Standard & Poor's 500 stock index closed slightly lower than yesterday's 3,257.85 all-time high, ending on Friday at 3,234.85.

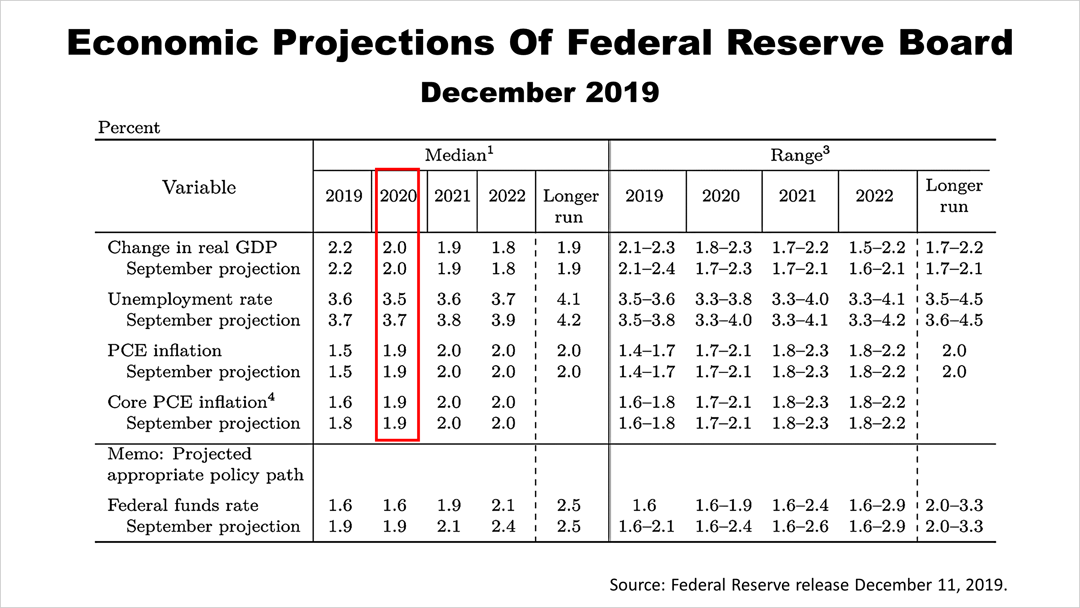

Here's why: The U.S. economy is expected to grow 2% after inflation in 2020.

That's not roaring growth, but the Fed's projections as of December 11th, 2019 were realistic and make it likely that the 10½-year old expansion will continue despite the new foreign crisis.

Although a war with Iran would present serious new risks, not to mention ethical questions, the evidence shows that the U.S. consumer's behavior is not much affected by foreign conflicts.

The U.S.-China trade war did not prevent the stock market from rising nearly 30% in 2019. Brexit did not stop the bull market. The bull market kept right on going.

The U.S. is exceptional among world economies because the consumer population makes 75% of U.S. gross domestic product and they keep growing in wealth by objective standards — despite foreign crises, politics, and ephemeral distractions.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.