Fickle Financial Headlines Brighten

Published Friday, September 13, 2019 at: 7:00 AM EDT

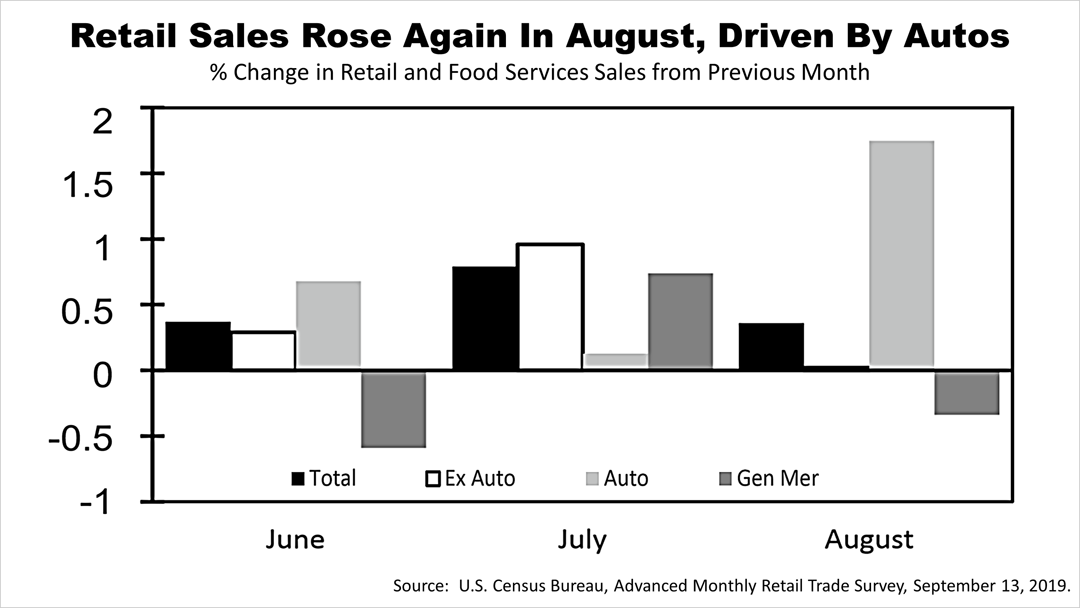

Retail sales, which drive 70% of U.S. economic growth, rose four-tenths of 1% in August, the U.S. Census Bureau said on Friday morning.

Suddenly headlines changed, growing less grim than they've been lately.

Friday's retail report quelled growing worries reflected in recent headlines in the financial press about the inversion of the yield curve, the 11-month plunge in manufacturing sector activity, the trade-war with China, and a global economic slowdown hurting the U.S. economy.

Friday's report of an increase of 0.4% in total retail sales in August over July was driven by a jump in auto sales.

Total retail sales in August were 4.1% higher than in August 2018. For the three-month period from June through August 2019, retail sales were up 3.7% from the same period a year ago.

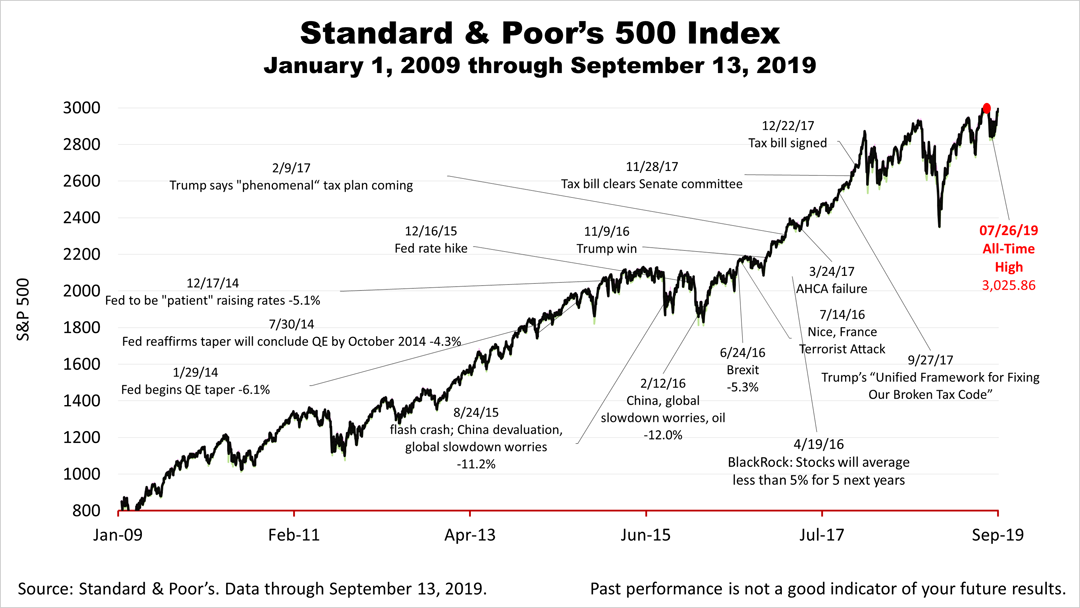

The Standard & Poor's 500 dropped fractionally on Friday but was up slightly from last week, closing less than 1% off its all-time record high, set in July.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.