Europe's Growth Problem And Your Portfolio

Published Friday, August 30, 2019 at: 7:00 AM EDT

Unprecedented negative yields in Europe continued to depress yields on U.S. Treasury bonds last week. The negative yields in Europe have caused an inversion of the U.S. yield curve and set off fears of a U.S. recession. Stocks rose anyway.

The yield on a 10-year German government bond this past week ticked lower, falling to -0.70%, making institutional bond investors from across the globe prefer U.S. Treasury bonds, which offered higher-yields.

Bonds are traded worldwide, and the most liquid types of bonds are U.S.-government guaranteed Treasurys, followed by German government-backed bonds. Since a 10-year U.S. Treasury bond pays a higher yield, institutions from across the globe are buying U.S. rather than German treasury bonds, depressing yields in the United States.

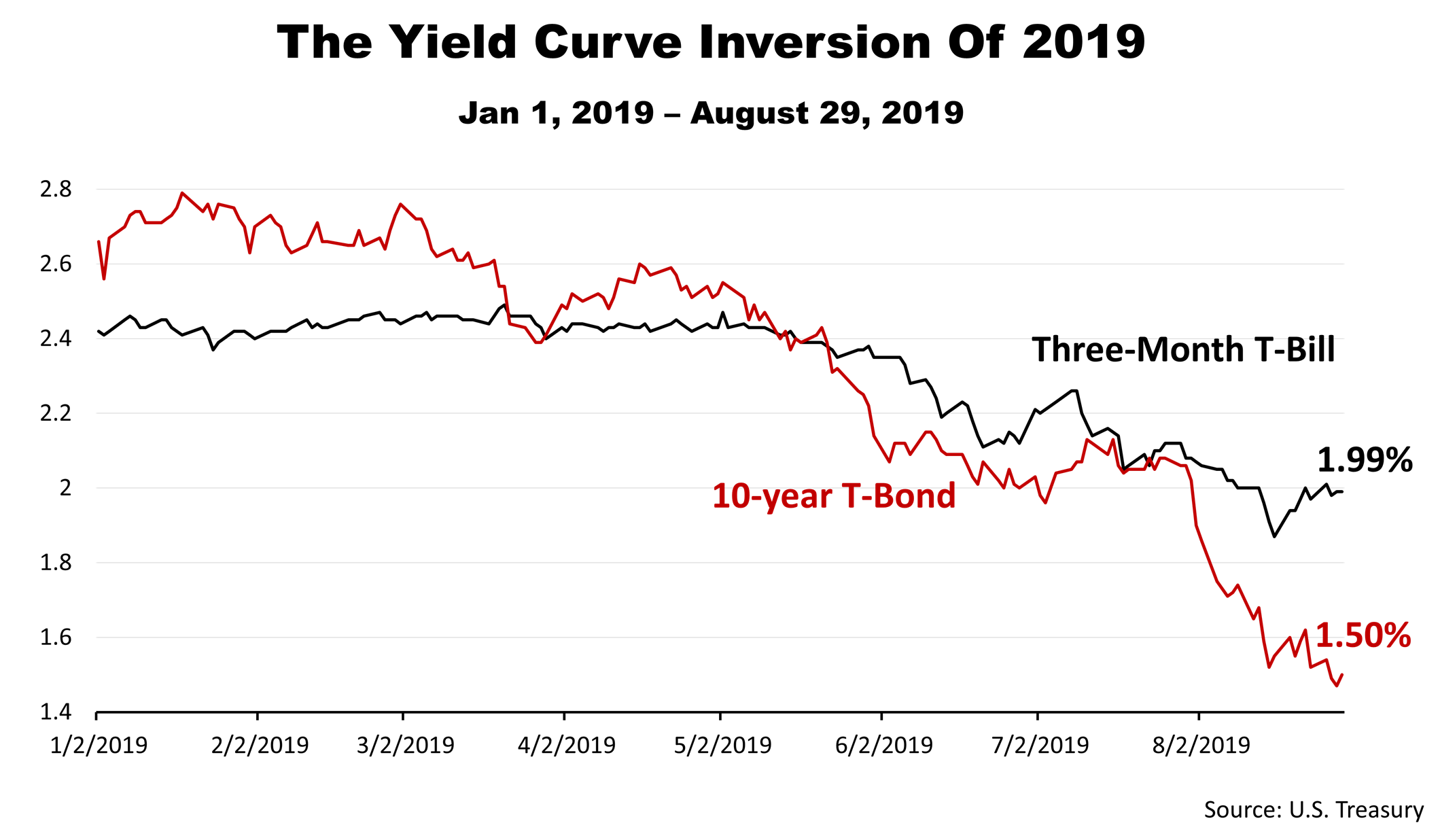

The extra cash moving into U.S. Treasury bonds instead of German bonds has pushed the yield of a 10-year U.S. government bond below that of the three-month Treasury bill for much of 2019.

On Friday, according to U.S. Treasury data, the yield on a three-month T-bill was 1.99%, while the long-term 10-year Treasury bond yielded 1.5%. Normally, yields on long-term fixed-income are higher than those on short-term instruments. Inversions in modern financial history usually were followed by recessions. However, the previous yield curves were caused by fundamental economic conditions and not negative yields in Europe, a condition never before seen.

Retirement income investors may want to consider how lower yields on fixed income allocations in their portfolios might be affected in the years ahead. The fundamental cause of low yields in Europe is its aging working age population, a long-term condition. The growth potential of the U.S. relative to other major economic powers is significant because of the demographic character of America. The baby-boom spawned an "echo" baby-boom generation that makes the growth path of the U.S. comparatively favorable.

The inversion of the yield curve has triggered fears of a recession, but it could be a false alarm. Indeed, the stock market did not seem alarmed. The Standard & Poor's 500 closed the week at 2,926.46, about 3% off its all-time record high, set in July.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.