A Tale Of Two Economies

Published Friday, August 9, 2019 at: 7:00 AM EDT

It's not the best of times, nor the worst. But the latest data is a tale of two of U.S. economies.

From a record-high level in September 2018 of 61.3%, manufacturing activity has plunged. In July, manufacturing activity slipped further, to 51.2%, according to the newly released monthly survey data of purchasing managers from the Institute of Supply Management.

This data series is designed to signal a recession when it falls to less than 50%. At 51.2%, the manufacturing economy inched closer to indicating a recession could be on the horizon.

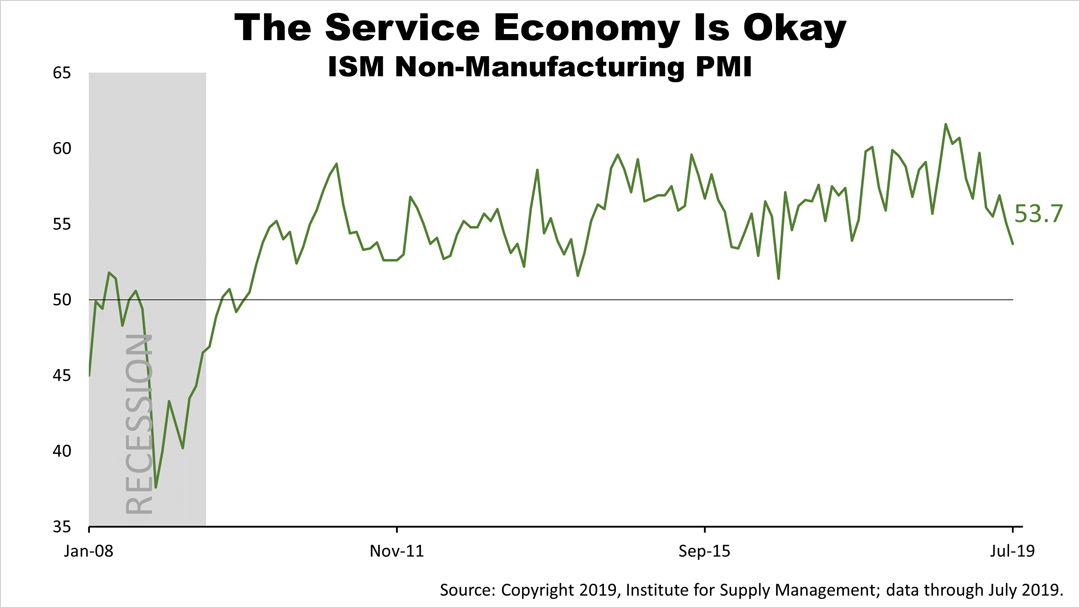

Meanwhile, the survey of purchasing managers at non-manufacturing companies, those in the service economy, declined to 53.7% in July. It too has plunged from its record level of 61.6% in September, but it's still well within its normal range.

The "Service Economy" is not gangbusters, like the tax-reform fueled peak in September 2018, but it's doing okay.

The service economy represents about 88% of U.S. growth. It's indicating growth is ahead, though less robust than a year ago.

Continued growth is confirmed by the survey of 60 economists conducted in early August by The Wall Street Journal.

The consensus forecast of 60 economic professionals for the next five quarters is for an average quarterly growth rate of 1.8%. That may seem paltry compared to the 3.1% in the first quarter of 2019, but it aligns with the expected long-term growth rate of the non-partisan government forecast published by the Congressional Budget Office.

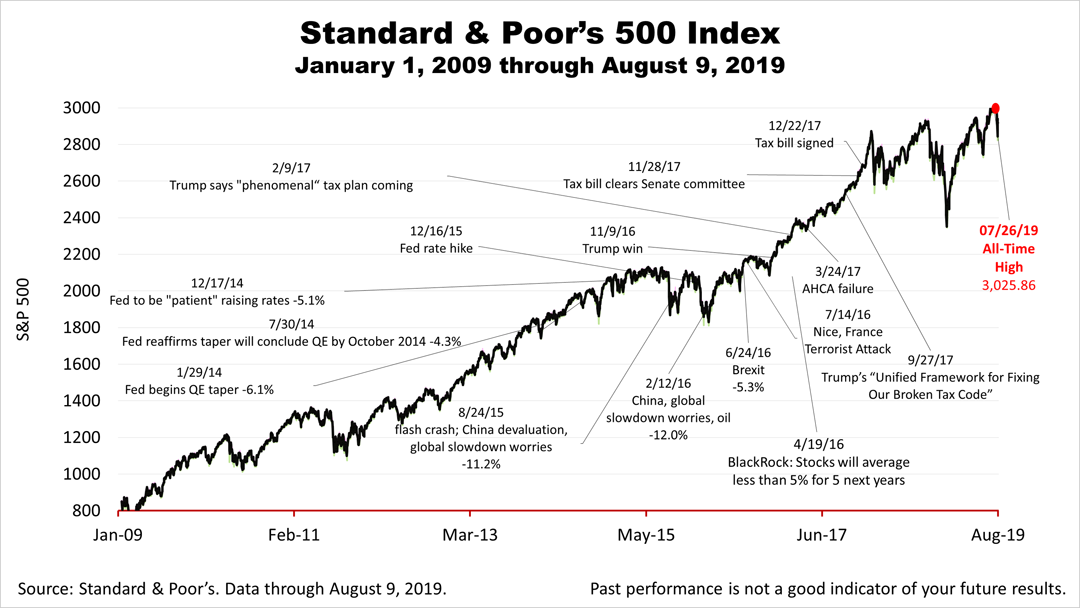

The Standard & Poor's 500 stock index of large public companies closed the week at 2,918.65, about 3% less than its all-time high.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.