Stocks Closed At A Record High; Should You Worry?

Published Friday, July 12, 2019 at: 7:00 AM EDT

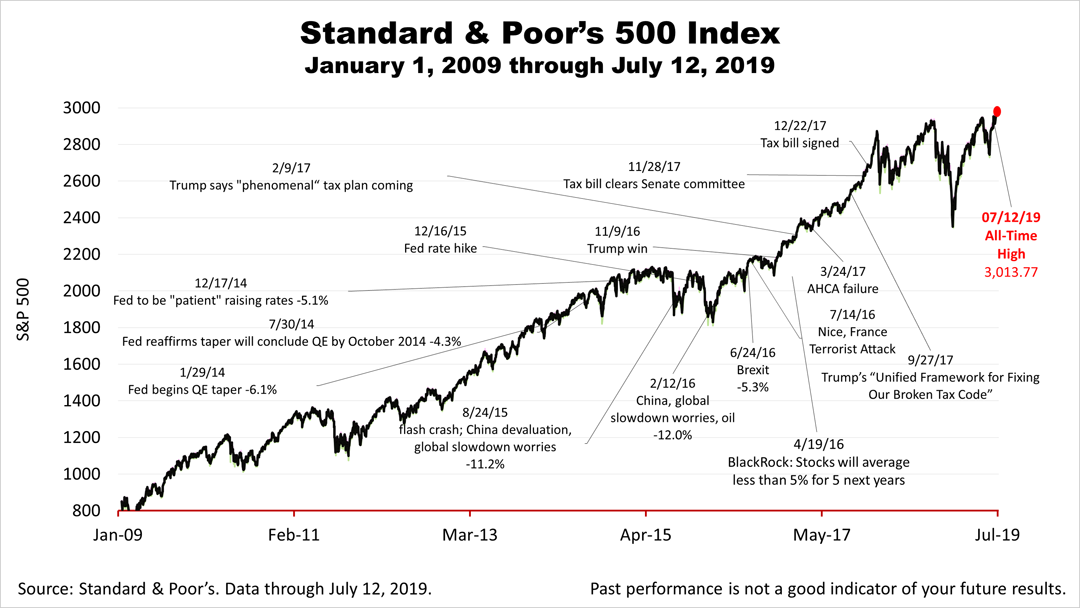

The Standard & Poor's 500 closed the week at an all-time high on Friday of 3,013.77. With the economy in its eleventh-year of expansion showing some possible signs of slower growth, should you be fearful?

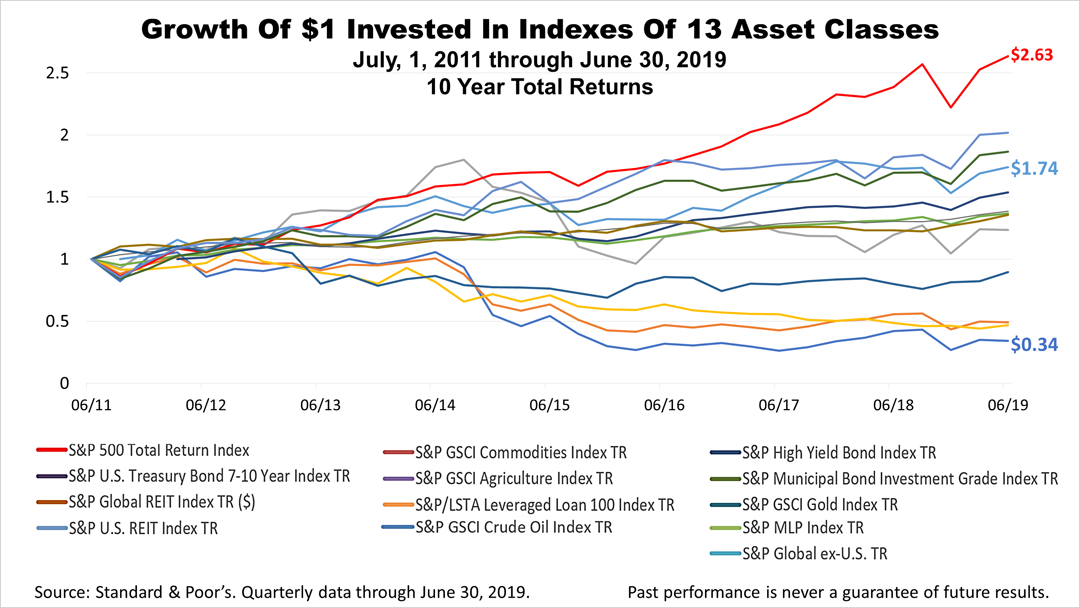

To answer, take a look at this chart showing just how spectacular America's blue-chip publicly-held companies performed for the decade ended June 30th, 2019.

The worst total return of the broad array of asset classes, represented by the indexes shown, was the Goldman Sachs Crude Oil Index. A dollar in the crude index declined in value to 34-cents in the same period.

A Goldman Sachs global stock index that excludes U.S. stocks grew to $1.74.

The U.S. has led the world's global economic comeback since the global financial crisis in 2008. A dollar invested in the S&P 500 stock index, as the country struggled to emerge from The Great Recession, grew to $2.63 on June 30th, 2019.

Of course, investors in U.S. stocks in the period following the financial crisis had no idea The Great Expansion was about to begin. They took a risk. It's paid off.

Past performance does not guarantee your future results. The economic expansion is the longest in modern U.S. history and signs of slower growth have appeared in recent data. However, a recession is not on the horizon. Uncertainty about the future is a permanent condition.

Investments with higher return potential carry greater risk for loss. Investing in small companies involves greater risks not associated with investing in more established companies, such as business risk, significant stock price fluctuations and illiquidity.

Foreign securities have additional risks, including exchange rate changes, political and economic upheaval, the relative lack of information about these companies, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

US Large Cap represented by S&P 500 Total Return Index. US Mid Cap represented by S&P MidCap 400 Total Return Index. US Small Cap represented by S&P Small Cap 600 Total Return Index. Non-US Developed represented by MSCI EAFE Index NR USD. Emerging represented by MSCI EM Index GR USD. Real Estate represented by S&P Global REIT Index TR USD. Natural Resources represented by S&P North American Natural Resources Total Return Index. Commodities represented by Deutsche Bank Liquid Commodity Optimum Yield Diversified Commodity Index Excess Return. US Bonds represented by Barclays US Aggregate Bond Index TR USD. TIPS represented by Barclays US Treasury US TIPS Index TR USD. Non-US Bonds represented by Barclays Global Treasury Index TR. Cash represented by USTREAS Stat US T-Bill 90 Day TR.

This article was written by a veteran financial journalist based on data compiled by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.