Understanding Economic Fundamentals

Published Thursday, March 8, 2018 at: 7:00 AM EST

At 105-months-old, this is the second-longest economic cycle in post-World War II America. For the last couple of years, a new phase of the expansion marked by rising interest rates began. Shifting fundamentals underpinning the economy can cause jitters in investment markets or spark changes in sentiment. In fact, the most recent correction - a loss of about 12% - was caused by fears of rising interest rates and inflation. So, let's set the record straight.

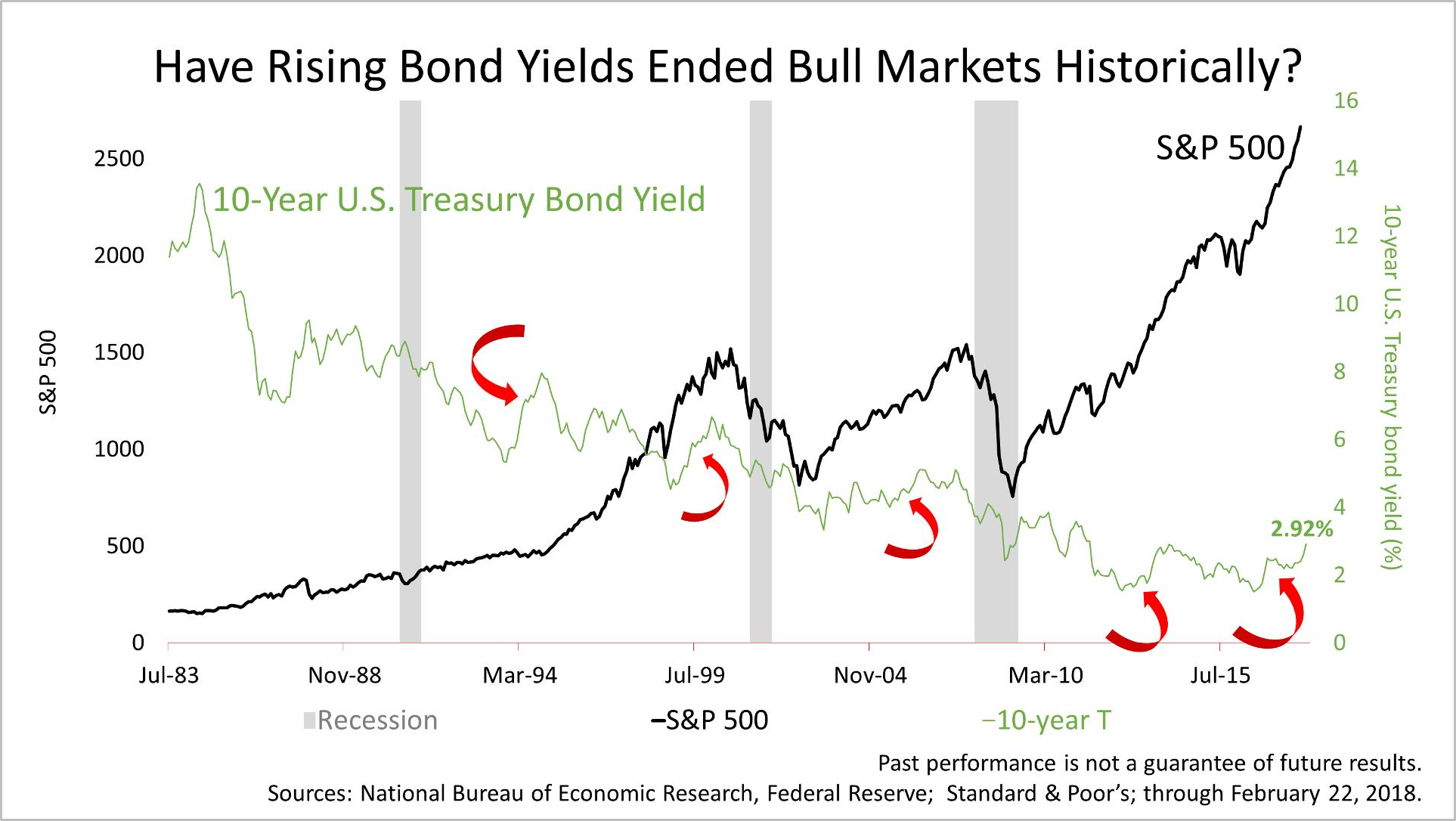

While no one can predict the stock market's near-term ups and downs, what we do know is that history shows rising rates are not bad for stocks. Actually, rising bond yields have often coincided with bull markets in stocks. The red arrows point to five periods since the 1990s when the yield on the 10-year U.S. Treasury bond rose sharply and stock prices rose at the same time.

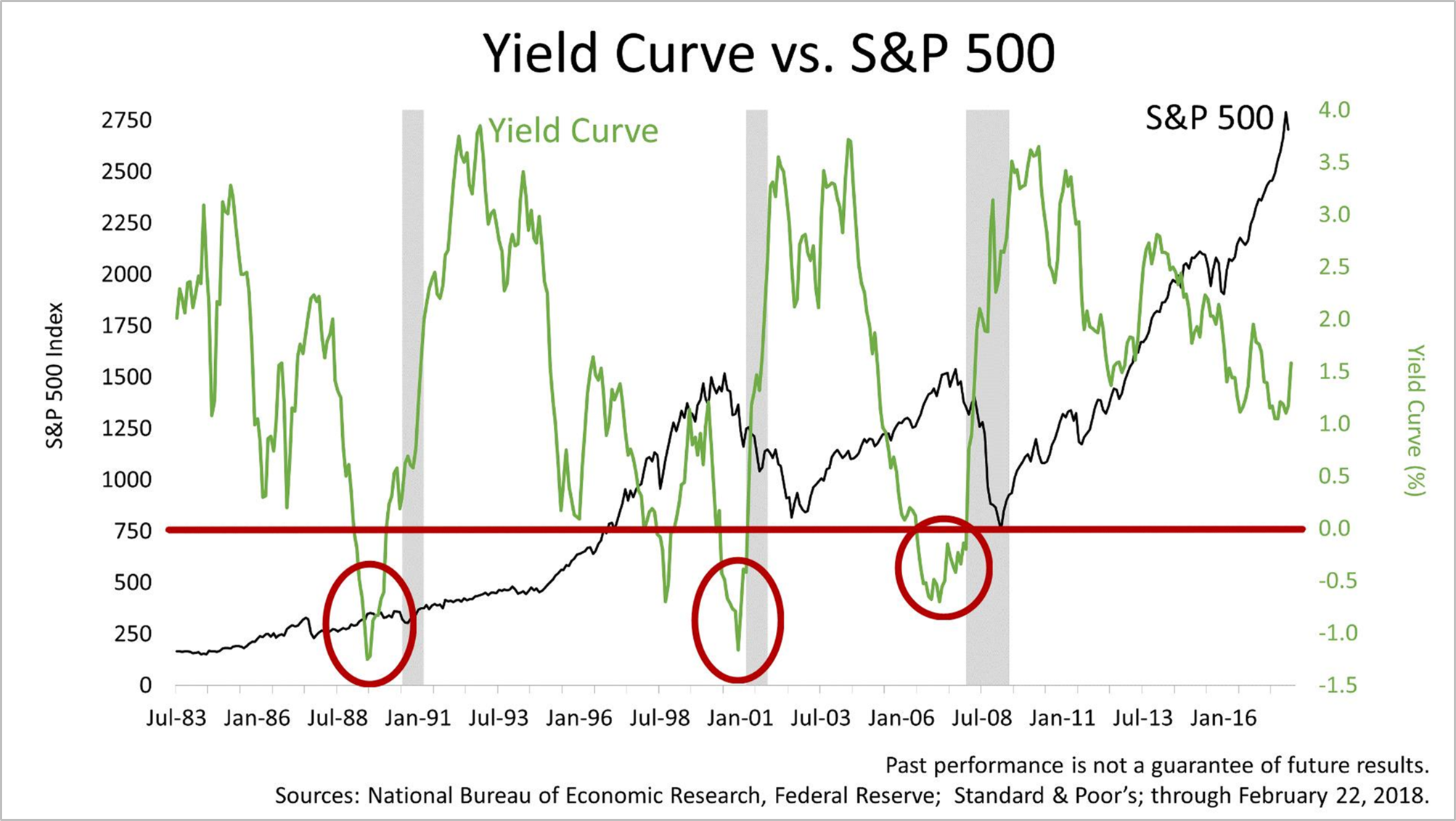

A more reliable economic and financial indicator is the yield curve - the difference between long-term bond yields and short-term interest rates. When the difference between the yield on 10-year U.S. Treasury Bond and the 30-Day U.S. Treasury Bill is more than zero, an expansion could continue just fine. However, when the yield curve is inverted - when a 30-Day Treasury yields more than a 10-year Treasury - that has been bad for the economy and stocks. Before each of the last three recessions, the yield curve went into negative territory.

Currently, the yield curve isn't near inversion. It's not signaling an end to the eight-and-a-half-year expansion and bull market. This 105-month old economic expansion is approaching the length of the longest expansion, the 120-month cycle in the 1990s, and it's still got legs. Of course, indicators are not a guarantee and must be considered in the context of history and your personal situation. But the yield curve is key to watch as this expansion nears the 120-month longest-ever cycle in the 1990s. Please let us know if you'd like to receive our email newsletter about wealth management.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.