Optimizing A Retirement Portfolio For Taxation

Published Friday, August 14, 2015 at: 7:00 AM EDT

Locating investments in the right type of account can make a big difference in your retirement savings and lifestyle.

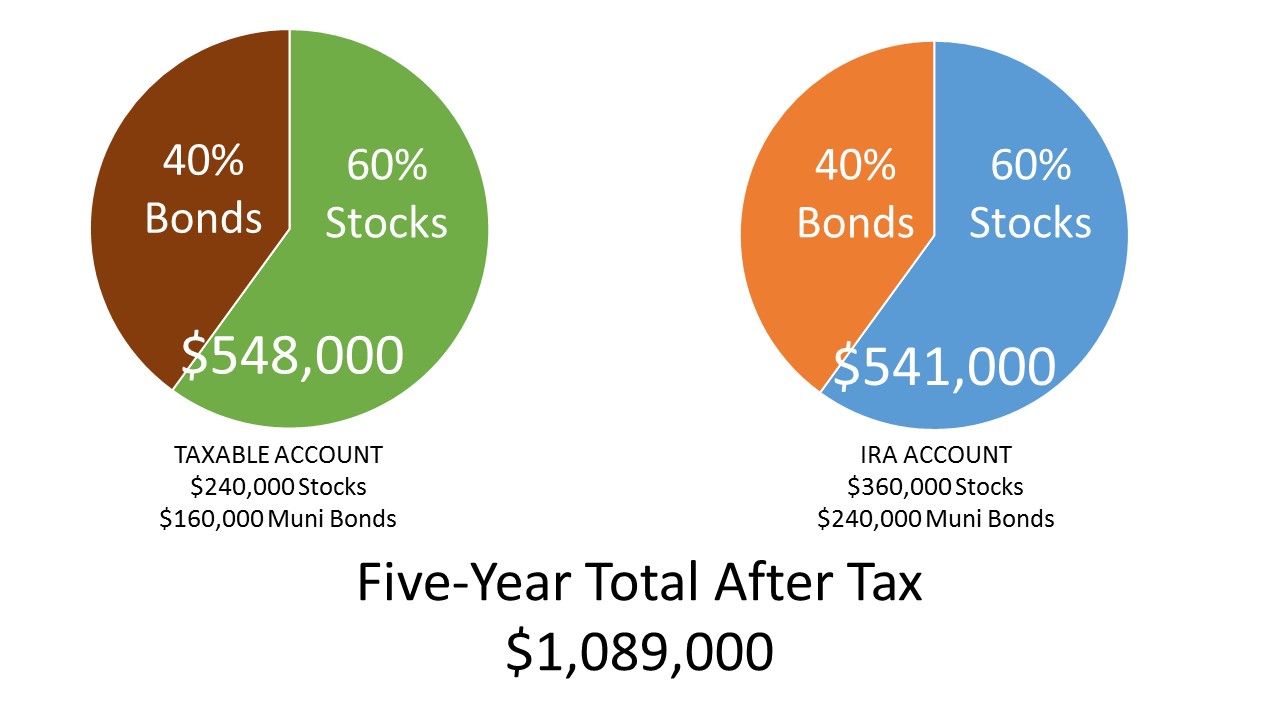

Here's the story, told through an example of a hypothetical couple — Jodi and Mark — with a $1 million in savings. Their tax-advantaged IRA accounts hold $360,000 in stocks and stock mutual funds, plus another $240,000 in taxable bonds. Jodi and Mark's taxable account holds $400,000, with a 60% in stocks returning 10% annually in capital gains and 40% in muni bonds yielding 3.6% of income.

To keep it real, let's make these very reasonable assumptions:

- bonds yield 6% of income annually

- stocks return a 10% capital gain annually

- residents of a state with high-income tax

- combined state and federal tax rate of 40% on income

- capital gains rate of 20%

After five years, the after-tax value of the taxable account is $548,000 and the IRA's after-tax value grows to $541,000 — a total of $1,089,000.

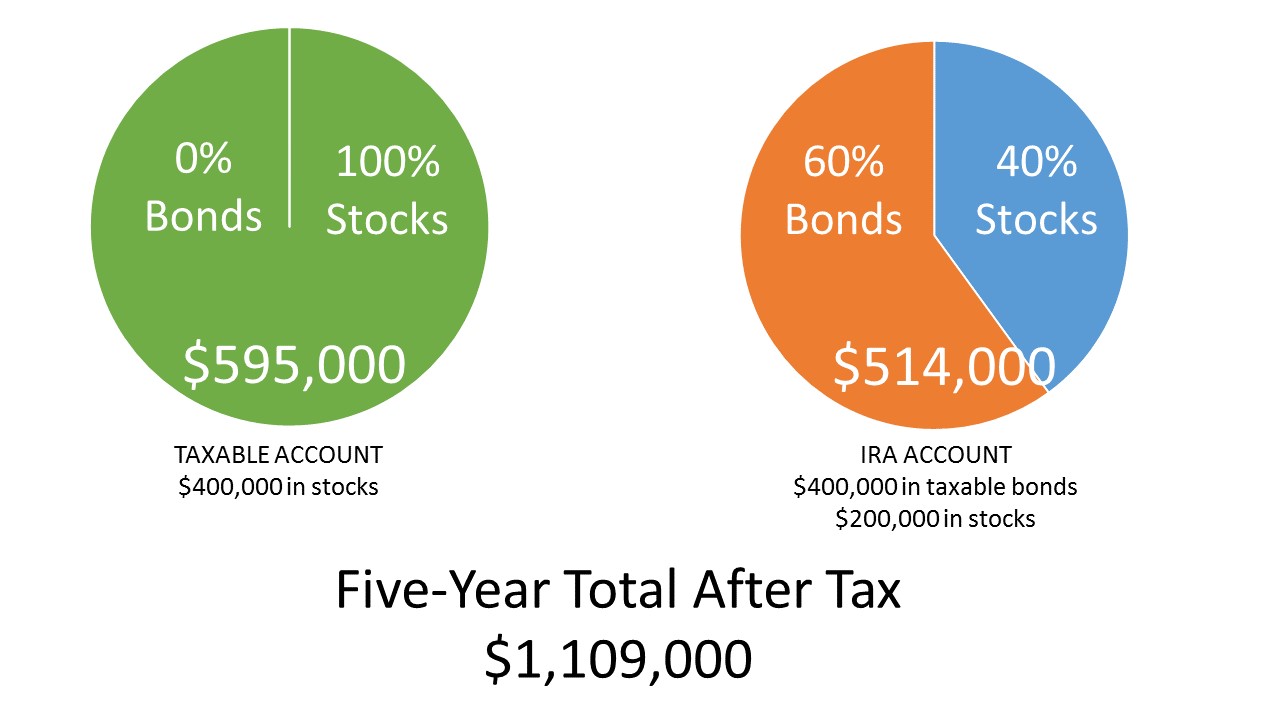

But now look at what happens when you apply a little strategic tax planning by employing a strategy to optimize the location of your investments to minimize taxes.

Optimizing for location would place all $400,000 in the taxable account in stocks to benefit as much as possible from the 20% favorable capital gains rate. Why settle for income from the muni bonds of 3.6%, when the after tax-return on stocks annually over the long run has averaged 8%. Meanwhile, optimizing the $600,000 IRAs would mean holding $400,000 in bonds and $200,000 in stocks. Instead of a 60% stock and 40% bond allocation, the IRA would hold the reverse — 40% in stocks and 60% in bonds.

The bottom-line: $1,109,000 expected value on the total portfolio after five years versus $1,089,000. Getting an extra 2% — $20,000 — over five years on a $1 million portfolio may seem insignificant, but it compounds without being taxed every year in the IRA. After 10 or 20 years, the tax-advantaged compounding becomes so powerful it prompted Albert Einstein to say "Compound interest is the eighth wonder of the world."

Because of the long-term nature of this strategy, getting started on the right course soon is wise. If you have questions about tax optimization, please contact us.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

© 2024 Advisor Products Inc. All Rights Reserved.